- #Personal daily expenses excel template how to

- #Personal daily expenses excel template update

- #Personal daily expenses excel template manual

- #Personal daily expenses excel template free

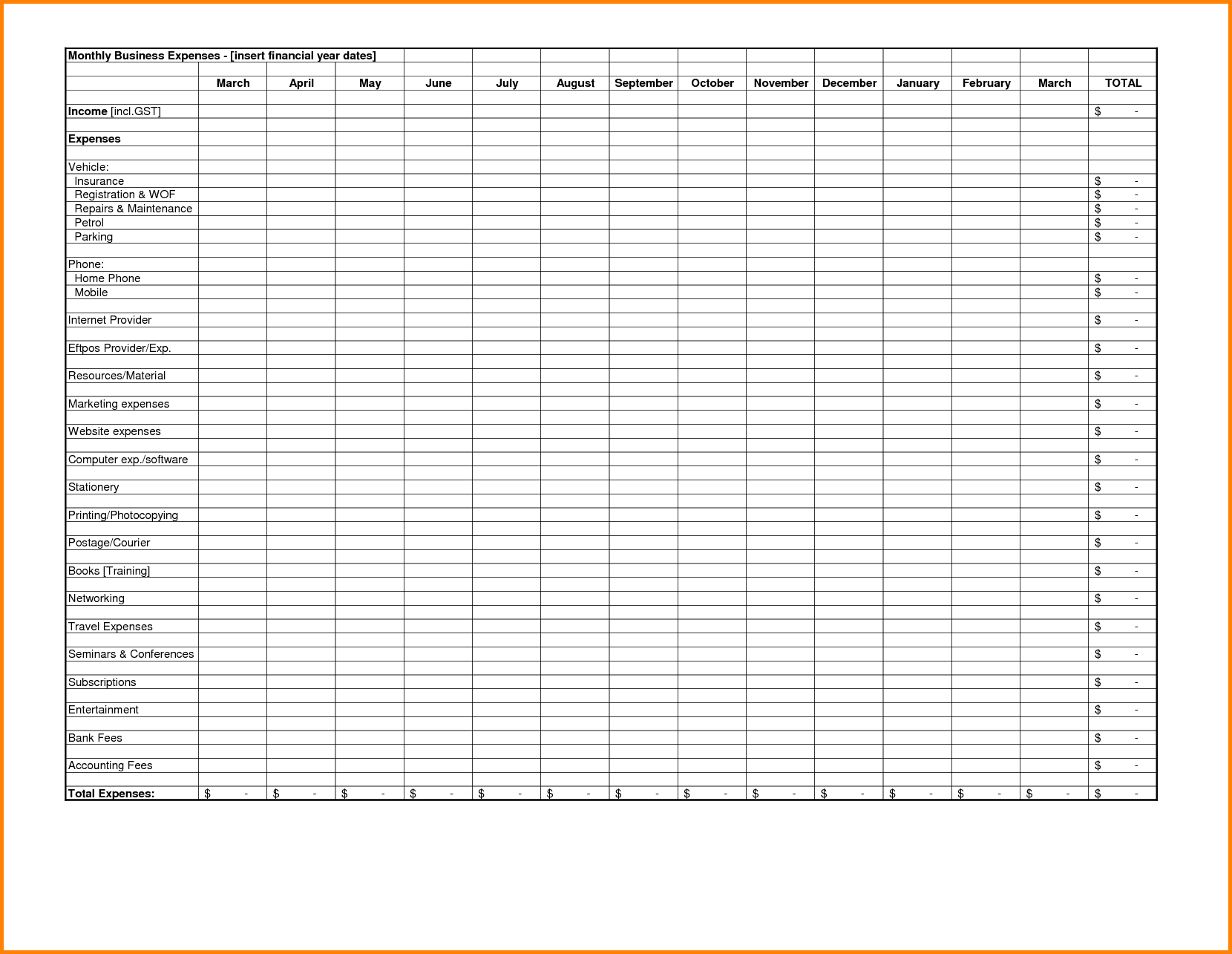

Find more suggested budget categories here.Įach transaction can only go in one category. Examples of common expense categories are mortgage/rent, utilities, kids, pets, health, groceries, restaurants, cars, clothing, travel, insurance, and debt repayment. The next step is sorting your expenses in a meaningful way. Learn more → Suggestions for categorizing expenses in your template

#Personal daily expenses excel template free

It’s completely free to try for 30 days, and you keep all data imported during your trial.

#Personal daily expenses excel template update

#Personal daily expenses excel template manual

Manual workflow: Log into your bank website. There are a couple of ways to get your bank and credit card transactions into your spreadsheets:

#Personal daily expenses excel template how to

How to get transactions from your bank into your expense template But first, we have a few suggestions about getting your transactions into your template and keeping up with categorization. You can even review your expenses on the go with free mobile apps for Microsoft Excel or Google Sheets.īelow are eight free expense tracking templates. Plus, with hundreds of free, pre-built templates, it’s easy to get started with tracking expenses in a spreadsheet. Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).Īfter you enter your transactions, the Transactions worksheet would look like this image below.Understanding (and improving) your financial situation starts with tracking your expenses.Īnd spreadsheets are one of the easiest tools for expense tracking.

Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash).‘Transfer’ type with positive amount for the account you are depositing the money into.‘Transfer’ type with negative amount from the account you are taking the money from.Transfer: When money is transferred from one account to another, create two records.If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value. Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount.Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.How much am I saving every month? How does that add to my net balance?.

0 kommentar(er)

0 kommentar(er)